Table of Contents

Introduction

In today’s real estate market, many individuals aspire to own a home. However, purchasing a property often requires a significant financial commitment. This is where a mortgage comes into play, offering individuals the opportunity to finance their dream homes. In this article, we will explore the ins and outs of mortgages, covering everything from the basics to the application process and beyond.

What is a Mortgage?

A mortgage is a loan provided by a financial institution or lender that enables individuals to purchase a home without paying the full purchase price upfront. It is a legal agreement where the borrower pledges the property as collateral to secure the loan. The loan amount is typically paid back in monthly installments, including both principal and interest, over a predetermined period.

Types of Mortgages

1. Fixed-Rate Mortgages

A fixed-rate offers borrowers a consistent interest rate throughout the loan term. This means that the monthly payment amount remains the same, providing stability and predictability for homeowners.

2. Adjustable-Rate Mortgages (ARMs)

An adjustable-rate mortgage, also known as an ARM, features an interest rate that can fluctuate over time. Initially, the interest rate is lower than that of a fixed-rated one, but it can adjust periodically based on market conditions.

3. Government-Backed Mortgages

Government-backed mortgages, such as FHA (Federal Housing Administration) loans or VA (Veterans Affairs) loans, are insured by federal agencies. These loans often have lower down payment requirements and more flexible eligibility criteria, making home-ownership more accessible for certain individuals.

Process Involved

The process involves several key steps that aspiring homeowners need to navigate. Understanding these steps can help streamline the process and ensure a smoother experience.

1. Choosing the Right One

Before diving into the process, it’s crucial to evaluate your financial situation, long-term goals, and preferences. This step involves researching and selecting the most suitable type for your needs.

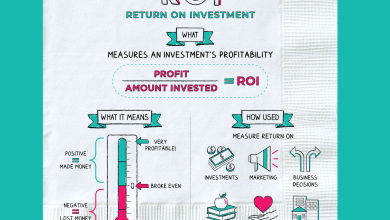

2. Rates

Rates play a significant role in determining the cost of borrowing. They are influenced by various factors, including the overall economy, inflation, and the borrower’s creditworthiness. It’s essential to keep an eye on rates to make informed decisions.

3. Understanding Its Terms

Mortgages come with their own set of terms and jargon. Familiarizing yourself with terms like amortization, down payment, and escrow can empower you during the process.

4. Preapproval

Obtaining a preapproval is a crucial step before house hunting. It involves submitting your financial information to a lender who will assess your creditworthiness and determine the loan amount you qualify for.

5. Application

Once you find the right property, you will need to complete an application. This involves providing detailed information about your finances, employment, and the property itself.

6. Closing/settlement

The closing, also known as the settlement, is the final step of the process. During this stage, you sign the necessary legal documents, pay any remaining closing costs, and officially become a homeowner.

Payments

After securing a mortgage, you will be responsible for making regular monthly payments. It’s important to understand how payments are structured and how they contribute to building equity in your home.

Refinancing

Refinancing involves replacing your existing loan with a new one. This can be done to take advantage of lower interest rates, change loan terms, or tap into your home’s equity for other financial needs.

Benefits of Owning a Home

Owning a home offers numerous advantages beyond providing shelter. It can serve as a long-term investment, offer tax benefits, and provide a sense of stability and pride.

Common Mistakes to Avoid

While navigating the process, it’s essential to be aware of common pitfalls to avoid. These include taking on more debt than you can handle, neglecting to shop around for the best rates, and not reading and understanding the terms and conditions of the agreement.

Conclusion

Purchasing a home is a significant milestone for many individuals, and a mortgage is often the key to achieving this goal. By understanding the process, exploring the different types of mortgages, and being aware of common mistakes, you can embark on your homeownership journey with confidence.

FAQs

Q1: How much do I need for a down payment?

A1: The required down payment amount can vary depending on the type and lender. Generally, it ranges from 3% to 20% of the home’s purchase price.

Q2: Can I get a mortgage with bad credit?

A2: While having a good credit score improves your chances of obtaining a mortgage, there are options available for individuals with less-than-perfect credit. Exploring government-backed loans or working on improving your credit can increase your chances of approval.

Q3: How long does the process typically take?

A3: The process can vary in duration, but it typically takes around 30 to 45 days from application to closing. However, factors like documentation, appraisal, and lender requirements can influence the timeline.

Q4: Can I pay off my mortgage early?

A4: Yes, it is possible to pay off early. However, it’s important to review your agreement for any prepayment penalties and consider the long-term financial implications before making this decision.

Q5: What is the difference between a broker and a lender?

A5: A broker acts as an intermediary between borrowers and multiple lenders, helping borrowers find the best terms and rates. A lender, on the other hand, is the financial institution or bank that provides the funds for the mortgage.