Table of Contents

Introduction

Return on Investment (ROI) is a fundamental financial metric used to evaluate the profitability of an investment relative to its cost. It provides valuable insights into the performance and efficiency of an investment. Understanding how to calculate ROI using the ROI formula is essential for investors and businesses alike. In this article, we will delve into the details of the ROI formula, its components, and its applications in investment analysis. So let’s explore the world of ROI and discover how to harness its power to make informed financial decisions.

Return on Investment || ROI Calculator

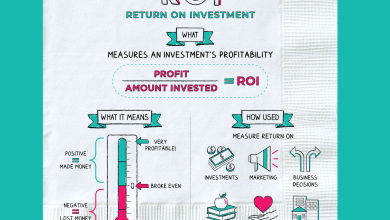

1. What is ROI?

ROI, or Return on Investment, is a financial ratio that measures the gain or loss generated from an investment relative to its cost. It is expressed as a percentage and represents the return earned per unit of investment. ROI is a versatile metric used in various contexts, including personal finance, business investments, and financial analysis.

2. The ROI Formula

The ROI formula is straightforward and easy to calculate. It is defined as:

ROI = (Net Profit / Cost of Investment) * 100

In this formula:

- Net Profit refers to the gain or return generated from the investment.

- Cost of Investment represents the initial amount of money invested.

3. Components of ROI Calculation

To calculate ROI accurately, it is crucial to understand the components involved in the formula. Let’s break them down:

a) Net Profit: Net Profit is the total gain or return obtained from the investment. It is calculated by subtracting the cost of investment from the final value or proceeds generated. Net Profit takes into account any additional income or capital appreciation resulting from the investment.

b) Cost of Investment: The Cost of Investment represents the initial amount of money invested in the project, including the purchase price, transaction fees, and any other associated costs. It is the baseline from which the return is measured.

4. Benefits of ROI Calculation

The calculation of ROI offers several benefits to investors and businesses:

a) Performance Evaluation: ROI allows investors to assess the performance of their investments accurately. By comparing the ROI of different investments, individuals can identify the most profitable ventures and make informed decisions regarding their investment portfolio.

b) Decision-making Tool: ROI serves as a valuable tool for decision-making. It enables investors to evaluate the potential returns and risks associated with different investment opportunities. By calculating ROI, investors can determine whether an investment is worth pursuing and aligns with their financial goals.

c) Investment Comparison: ROI facilitates easy comparison of investment options. By calculating and comparing the ROIs of different investments, individuals can identify the projects with the highest potential returns and make investment choices accordingly.

5. Limitations of ROI Calculation

While ROI is a useful metric, it does have certain limitations that should be considered:

a) Timeframe: ROI does not account for the time value of money. It treats all gains and costs equally, regardless of when they occur. This limitation becomes particularly important when comparing investments with different durations or cash flow patterns.

b) Simplistic Approach: ROI provides a simplified view of investment performance. It does not capture factors such as cash flow timing, compounding effects, or risk considerations. Therefore, relying solely on ROI may not present a comprehensive picture of investment profitability.

c) Subjectivity: ROI calculation relies on accurate measurement and attribution of costs and profits. The subjectivity involved in assigning values to various elements of the formula can impact the reliability and comparability of ROI calculations.

6. Enhancing ROI Analysis

To overcome the limitations of ROI, it is beneficial to consider complementary financial metrics and analysis techniques. Some approaches that can enhance ROI analysis include:

a) Time-Weighted ROI: Time-Weighted ROI adjusts for the time value of money by considering the timing and duration of cash flows. It provides a more accurate representation of investment performance, especially when comparing investments with different timeframes.

b) Risk Assessment: Incorporating risk assessment techniques, such as calculating risk-adjusted return metrics like the Sharpe ratio or considering the probability of achieving the expected returns, provides a more comprehensive analysis of investment performance.

c) Cash Flow Analysis: Analyzing the cash flows generated by an investment over its lifecycle can provide valuable insights into its profitability. Cash flow analysis helps identify periods of positive or negative cash flow, which may impact the overall return.

7. Real-World Examples of ROI Calculation

Let’s explore a couple of real-world examples to understand how the ROI formula can be applied:

Example 1: Suppose an individual invests $10,000 in stocks and sells them after a year for $12,500. The net profit is $12,500 – $10,000 = $2,500. Plugging these values into the ROI formula:

ROI = ($2,500 / $10,000) * 100 = 25%

The ROI in this case is 25%, indicating a 25% return on the initial investment.

Example 2: A business invests $100,000 in a marketing campaign, resulting in $150,000 in additional revenue. The net profit is $150,000 – $100,000 = $50,000. Applying the ROI formula:

ROI = ($50,000 / $100,000) * 100 = 50%

The ROI in this scenario is 50%, implying a 50% return on the marketing investment.

Conclusion

Understanding how to calculate ROI using the ROI formula is essential for evaluating investment performance and making informed financial decisions. By considering the net profit and cost of investment, investors can assess the profitability of their ventures and compare various investment opportunities. While ROI provides a useful snapshot of investment returns, it is important to consider its limitations and complement it with other financial analysis techniques for a comprehensive evaluation. So, leverage the power of ROI calculation to gain insights into your investments and maximize your financial returns.