Accounting for Indirect Materials: When materials originally requisitioned for a job are not used and are returned to the storeroom accompanied by a returned materials report, Materials is debited and Work in Process is credited for accounting for indirect materials. The return to Materials requires entries on the materials ledger card as well as on the job order cost sheet.

Accounting for Indirect Materials: Materials requisitions are also used to secure indirect materials or supplies from the storeroom. These requisitions are charged to the factory overhead control account and to departmental expense analysis sheets which constitute a subsidiary ledger for the departments using the supplies.

Supplies issued might also be charged to marketing or administrative expense accounts.

Requisitions for indirect materials result in the entry

Factory Overhead Control 6,000 Dr.

Indirect Materials 6,000(subsidiary record)

Materials 6,000 Cr.

It is important to note that the above entry relating to Accounting for Indirect Materials is made when indirect materials are issued and not when purchased. At the time of purchase, indirect materials are charged to Materials or to separate account such as Indirect Materials or Supplies,

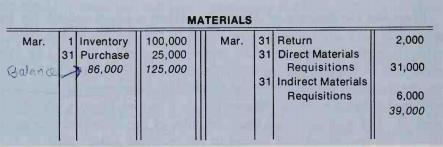

The effect of all the preceding transactions on the materials account is shown below.

Indirect materials are types of indirect costs and are treated as overhead. Indirect materials are materials that are used in manufacturing process and they are not directly traceable to a cost element. Indirect material costs are considered overhead costs and treated accordingly.